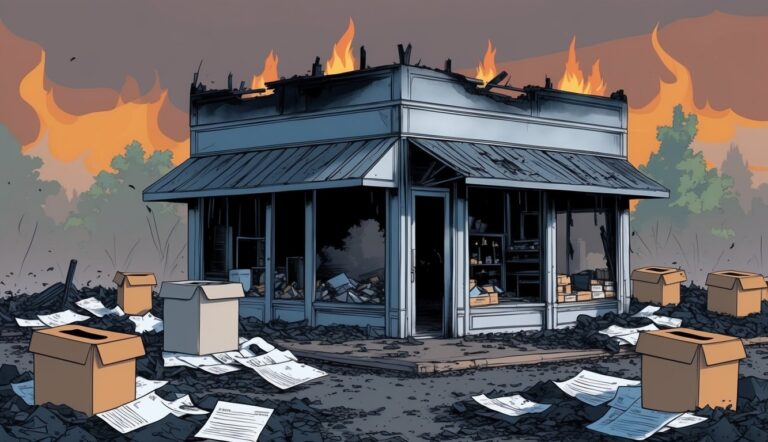

The recent wildfires in California have devastated countless small businesses and individuals, leaving many without homes, jobs, or operations.

Business Struggles Amid Disaster

Raquel Smeir, affectionately known as “Rockey,” opened My Friends Café in Sierra Madre during the pandemic year of 2021.

While her café thankfully escaped physical damage from the fires, she faced numerous hurdles.

Power outages and a mandatory evacuation impacted her staff and customers, as well as the wider community.

Once she was finally able to return, Rockey confronted significant financial strains.

Her café had to close its doors, which led to wasted inventory and compounded the anxiety felt throughout her neighborhood.

The financial struggles of small businesses during disasters like this can often go overlooked.

Rockey shared that, alongside payroll, rent, and taxes, the halt in revenue generated during nearly a week of closure severely strained her finances.

The loss of inventory made matters even worse.

Available Relief Options

In the wake of the wildfires, various private fundraising initiatives have sprung up on platforms like GoFundMe in an effort to support those affected.

Relief options are available at both local and national levels for individuals and businesses grappling with the aftermath.

Recently, an announcement was made regarding a freeze on federal loans and grants, yet it remains unclear if disaster assistance is included in this suspension.

However, individuals looking for disaster aid can still apply through the Small Business Administration (SBA) website.

The SBA typically offers Economic Injury Disaster Loans aimed at providing essential working capital after calamities, and these loans are often available even if a business hasn’t suffered direct physical damage.

Businesses that qualify may receive loans of up to $2 million to cover fixed costs, payroll, accounts payable, and other important expenses that the disaster disrupted.

Homeowners, too, have access to disaster loans, which can reach up to $500,000 for repairing or replacing damaged properties.

Additionally, they can receive up to $100,000 to replace or repair personal items, including vehicles.

On a local level, the Los Angeles Chamber of Commerce has taken action to assist small businesses impacted by the wildfires by establishing a fund.

This initiative has earmarked $1 million for grants ranging from $5,000 to $10,000 to help affected entrepreneurs.

The Chamber will also offer business recovery webinars and advisory services to further aid recovery efforts.

Community Development Financial Institutions (CDFIs), which are nonprofit entities, are another resource for support through grants and loans.

They often extend more favorable terms compared to traditional banks.

Maintaining Vigilance Against Scams

Rockey chose to pursue these avenues and has submitted applications for an SBA loan and two grants.

However, she anticipates not receiving updates until February or March.

Thankfully, she did secure a grant from LiftFund, a CDFI based in San Antonio, Texas, which has provided crucial support to stabilize her business.

Reflecting on her journey to reopen, Rockey likened it to starting a new venture, although she now possesses invaluable lessons learned from her experience.

Support tailored to specific industries is also available.

Austin Manuel, the owner of Healing Force of the Universe—a record store and event venue in Pasadena—has yet to seek aid, even as he manages the aftermath of wind damage that allowed smoke and ash to enter his space.

This situation led to canceled events and postponed music classes.

Manuel is contemplating assistance from industry-focused organizations like MusiCares and Live Nation, and he may explore the possibility of an SBA loan.

He mentioned that many upcoming events will serve as fundraisers, aiming to support the local community during this difficult time.

As business owners seek out appropriate assistance, they must remain vigilant against scams, as fraudulent schemes often target those in vulnerable situations.

It’s essential to be skeptical of offers that seem too appealing and to tread carefully when it comes to sharing personal information.

Carolina Martinez, CEO of CAMEO Network, warns that small businesses in challenging times often attract the attention of predatory lenders looking to exploit their precarious financial positions.

She urges business owners to stay alert and to thoroughly understand any agreements or offers they encounter.

Source: Insurancejournal.com