Your credit score impacts many aspects of your financial life, including the cost of insurance.

Many insurers use credit-based insurance scores to help determine premiums in states where it’s allowed.

Understanding this connection can help you take control of your finances and potentially save money on insurance.

Improving your credit score and lowering your insurance premiums go hand in hand. By taking steps to boost your creditworthiness, you may see a decrease in your insurance costs.

This article will explore seven effective strategies you can implement to enhance your credit profile and potentially reduce your insurance expenses.

1) Pay Bills on Time

Paying your bills on time is crucial for improving your credit score.

Your payment history accounts for a significant portion of your credit score calculation.

Consistently making timely payments demonstrates financial responsibility to creditors.

This positive behavior can lead to a higher credit score over time.

Set up automatic payments for your bills to avoid missing due dates.

Many companies offer this option, making it easier to stay on track.

If you can’t pay the full amount, try to at least make the minimum payment by the due date.

This helps prevent late fees and negative marks on your credit report.

Create a budget to ensure you have enough funds to cover your bills each month.

Prioritize essential payments like utilities, rent, and credit card bills.

Consider using calendar reminders or smartphone apps to alert you when bills are coming due.

This can help you stay organized and avoid overlooking payment deadlines.

If you’re struggling to pay a bill, contact the creditor before the due date.

Some may offer payment plans or temporary hardship programs to help you stay current.

By paying your bills on time, you’re not only improving your credit score but also potentially lowering your insurance premiums.

Many insurers use credit-based insurance scores when determining rates, so a higher credit score could lead to lower premiums.

2) Reduce Outstanding Debt

Paying down your existing debt is a crucial step in improving your credit score and potentially lowering your insurance premiums.

Focus on reducing your credit card balances and other high-interest debts first.

Prioritize high-interest debt to minimize the overall interest you’ll pay.

As you settle one debt, redirect those payments to the next debt to accelerate your progress.

Consider using a personal loan to consolidate your credit card debt.

This strategy can improve your credit score by reducing your credit utilization ratio and potentially securing a lower interest rate.

Aim to keep your credit utilization below 30% of your available credit limit.

This means if you have a $10,000 credit limit, try to maintain a balance under $3,000.

Set up automatic payments to ensure you never miss a due date.

Consistent, on-time payments are essential for maintaining a good credit score and demonstrating financial responsibility to insurers.

By reducing your outstanding debt, you’ll not only improve your credit score but also free up more of your income.

This can make it easier to afford comprehensive insurance coverage without straining your budget.

3) Dispute Credit Report Errors

Regularly check your credit reports for inaccuracies.

Errors on your credit report can negatively impact your credit score and lead to higher insurance premiums.

If you spot any mistakes, take action to dispute them promptly.

You have the right to challenge any information you believe is incorrect.

Start by gathering evidence to support your claim.

This may include bank statements, payment receipts, or other relevant documents.

You can file a dispute online with each of the three major credit bureaus: Equifax, Experian, and TransUnion.

Alternatively, you can submit your dispute by mail or phone.

When filing a dispute, clearly explain the error and provide copies of supporting documents.

Be specific about what information you believe is inaccurate.

The credit bureaus are required to investigate your claim within 30 days.

They will contact the information provider to verify the disputed information.

If the investigation confirms an error, the credit bureau must correct it on your report.

They will also notify you of the outcome.

You can request that the credit bureau send correction notices to anyone who received your report in the past six months.

By successfully disputing errors, you can improve your credit score and potentially lower your insurance premiums.

Remember to follow up if you don’t receive a response within 45 days.

4) Avoid Opening New Credit Accounts

Opening new credit accounts can temporarily lower your credit score.

When you apply for new credit, lenders perform a hard inquiry on your credit report, which can cause a slight dip in your score.

Multiple hard inquiries in a short period can have a more significant impact.

This signals to lenders that you may be taking on too much debt, potentially making you a riskier borrower.

New accounts also reduce the average age of your credit history. Credit history length is a factor in determining your credit score, so a shorter average can negatively affect it.

If you need to open a new account, do so sparingly.

Try to space out credit applications by several months.

This approach allows your credit score to recover between applications.

Before applying for new credit, consider if it’s truly necessary.

If you already have sufficient credit available, it may be better to use existing accounts rather than opening new ones.

Remember that keeping old accounts open can be beneficial.

They contribute to a longer credit history and can help maintain a lower overall credit utilization ratio.

5) Become an Authorized User

Becoming an authorized user on someone else’s credit card account can potentially boost your credit score.

This strategy involves having a trusted person, such as a family member or close friend, add you to their credit card account.

When you become an authorized user, the account’s payment history and credit utilization may be reported to credit bureaus under your name.

If the primary account holder has a strong credit history, this can positively impact your credit score.

It’s important to choose the right person to partner with for this strategy.

Look for someone who consistently makes on-time payments and maintains low credit card balances.

Their responsible credit behavior can help improve your credit profile.

Keep in mind that being an authorized user may affect your credit in different ways.

The impact depends on factors such as the age of the account and the primary user’s credit habits.

You don’t necessarily need to use the card or make payments to benefit from being an authorized user.

However, it’s crucial to discuss expectations and responsibilities with the primary account holder beforehand.

Remember that this method is most effective when combined with other credit-building strategies.

Continue to practice good credit habits on your own accounts while benefiting from the authorized user status.

6) Maintain a Low Credit Utilization Ratio

Your credit utilization ratio is the amount of credit you’re using compared to your total available credit.

Keeping this ratio low can significantly boost your credit score.

Aim to use no more than 30% of your available credit at any time.

For even better results, try to keep it under 10%.

This shows lenders that you’re responsible with credit and not overextended.

There are several ways to lower your credit utilization ratio.

One effective method is to ask for a credit limit increase.

If approved, this instantly reduces your utilization ratio without requiring you to change your spending habits.

Another strategy is to use more than one credit card.

By spreading your purchases across multiple cards, you can keep the utilization on each card lower.

Consider paying your credit card bills before the statement closing date.

This can help ensure a lower balance is reported to the credit bureaus.

Setting up balance alerts can help you stay on top of your spending.

This way, you’ll know when you’re approaching your desired utilization limit.

7) Use Credit Builder Loans

Credit-builder loans can help boost your credit score if you have limited credit history.

These loans work differently from traditional loans, as you don’t receive the money upfront.

The lender deposits the loan amount into a savings account.

You make monthly payments to build up the balance.

Once you’ve paid off the loan, you receive the full amount.

Credit-builder loans typically range from $300 to $1,000.

The loan term usually lasts 12 to 24 months.

Your payments are reported to credit bureaus, helping establish a positive payment history.

To get a credit-builder loan, research potential lenders.

Banks, credit unions, and online lenders often offer these products.

Choose a loan amount you can comfortably manage.

Before applying, gather necessary documents like proof of income and identification.

Read the terms and conditions carefully to understand interest rates and fees.

Some lenders may offer immediate access to a portion of the loan funds.

For example, MoneyLion provides credit-builder loans up to $1,000 with partial upfront access.

Make all payments on time to maximize the credit-building benefits.

Set up automatic payments if possible to avoid missed due dates.

Remember, credit-builder loans are tools to improve your credit score.

Use them responsibly and in conjunction with other credit-building strategies for the best results.

Understanding Credit Scores

Credit scores play a crucial role in your financial life, influencing loan approvals and insurance premiums.

They are complex numerical representations of your creditworthiness based on various factors.

What Is a Credit Score?

A credit score is a three-digit number that summarizes your credit history.

It typically ranges from 300 to 850, with higher scores indicating better creditworthiness.

Lenders and insurers use this score to assess your financial reliability.

Credit scores are calculated using complex algorithms that analyze your credit report data.

The two main scoring models are FICO and VantageScore.

Your credit score can affect your ability to secure loans, credit cards, and even rental agreements.

It also influences the interest rates you’re offered on financial products.

Factors That Affect Credit Scores

Several key factors contribute to your credit score calculation:

-

Payment history (35% of FICO score): This reflects your track record of paying bills on time.

-

Credit utilization (30%): The amount of credit you’re using compared to your credit limits.

-

Length of credit history (15%): How long you’ve had credit accounts open.

-

Credit mix (10%): The variety of credit types you have, such as credit cards, mortgages, and auto loans.

-

New credit inquiries (10%): How often you apply for new credit.

Maintaining a good credit score requires consistent responsible financial behavior.

Regularly checking your credit score can help you understand your financial standing and identify areas for improvement.

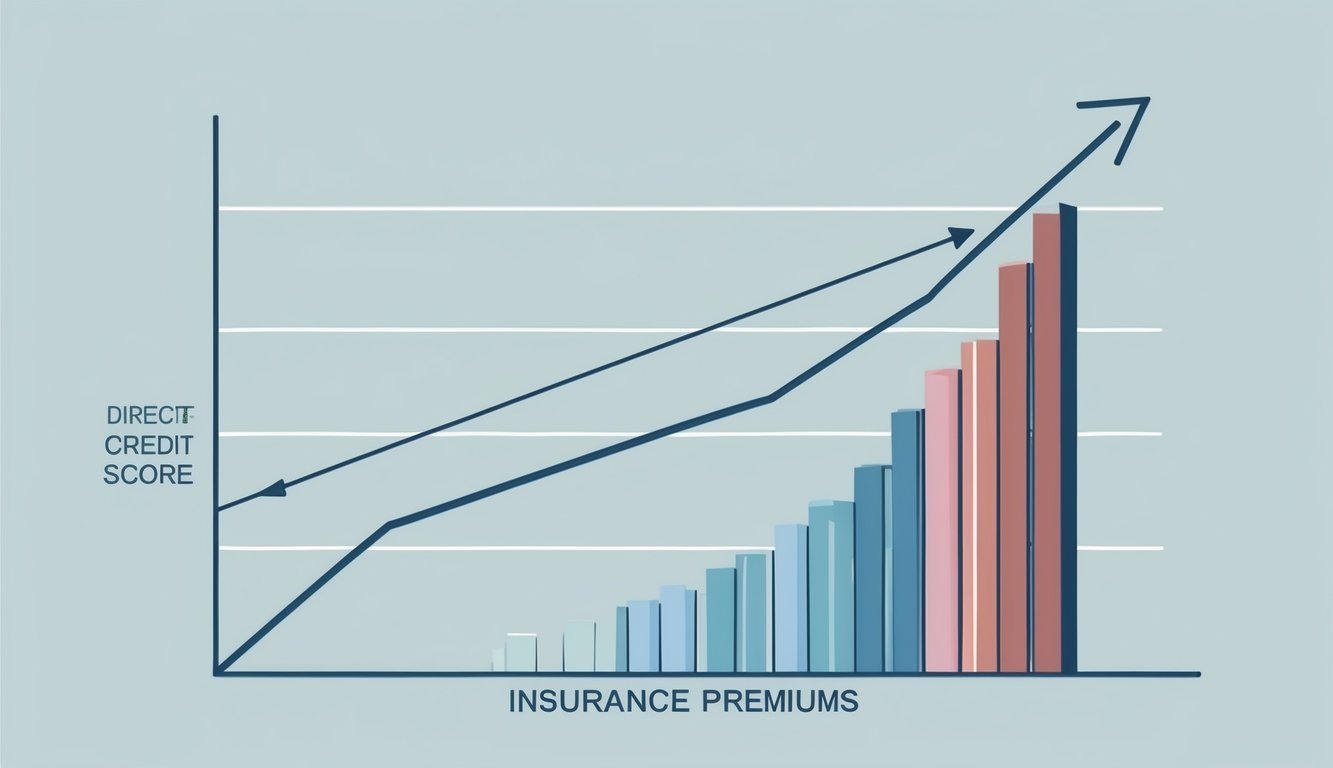

The Relationship Between Credit Scores and Insurance Premiums

Credit scores play a significant role in determining insurance premiums.

Insurers use specialized scoring models to assess risk and set rates.

The Impact of Credit Scores on Insurance Rates

Your credit score can have a substantial effect on your insurance rates. Insurers use credit-based insurance scores to predict the likelihood of you filing a claim.

A higher score typically results in lower premiums, while a lower score may lead to higher rates.

This practice is common in many states, though some have restrictions or bans on using credit information for insurance pricing.

The impact can be significant – in some cases, drivers with poor credit may pay up to 2.5 times more than those with excellent credit.

To potentially lower your rates, focus on improving your credit score.

Pay bills on time, reduce debt, and avoid applying for new credit frequently.

How Insurers Use Credit Scores

Insurance companies don’t use your standard credit score.

Instead, they employ credit-based insurance scores, which are calculated differently.

These scores consider factors like payment history, outstanding debts, and length of credit history.

Insurers argue that credit information helps predict risk more accurately.

They claim that individuals with better credit tend to file fewer claims.

This allows them to offer lower rates to these customers.

Unlike regular credit scores, you can’t easily check your credit-based insurance score.

Some insurers may provide it upon request, but it’s not guaranteed.

To improve your score, focus on the same habits that boost your regular credit score.

Long-Term Strategies for Maintaining a High Credit Score

Maintaining a high credit score requires ongoing effort and smart financial habits.

Regular credit monitoring and responsible credit use are key pillars for long-term success.

Consistent Monitoring of Credit Reports

Tracking your credit score allows you to spot issues quickly and take action.

Check your credit reports from all three major bureaus annually for free at AnnualCreditReport.com.

Review reports carefully for errors or suspicious activity.

Dispute any inaccuracies promptly with the credit bureau and creditor.

Consider using a credit monitoring service for real-time alerts about changes to your credit profile.

Many credit card issuers offer free credit score access.

Set calendar reminders to review your credit reports every few months.

This habit helps you stay on top of your financial health and catch potential problems early.

Best Practices for Using Credit Responsibly

Pay all bills on time, every time.

You can set up automatic payments or reminders to avoid late fees and negative marks on your credit report.

Keep your credit utilization low.

Aim to use less than 30% of your available credit across all cards.

Also, pay balances in full each month when possible.

Maintain a mix of credit types over time, such as credit cards, installment loans, and mortgages.

This diversity can positively impact your score.

Avoid opening too many new accounts in a short period.

Each application can result in a hard inquiry, temporarily lowering your score.

Keep old accounts open, even if unused.

Length of credit history is a factor in your score, so preserving longstanding accounts can be beneficial.