Health insurance is a crucial investment for protecting your financial well-being and ensuring access to quality healthcare.

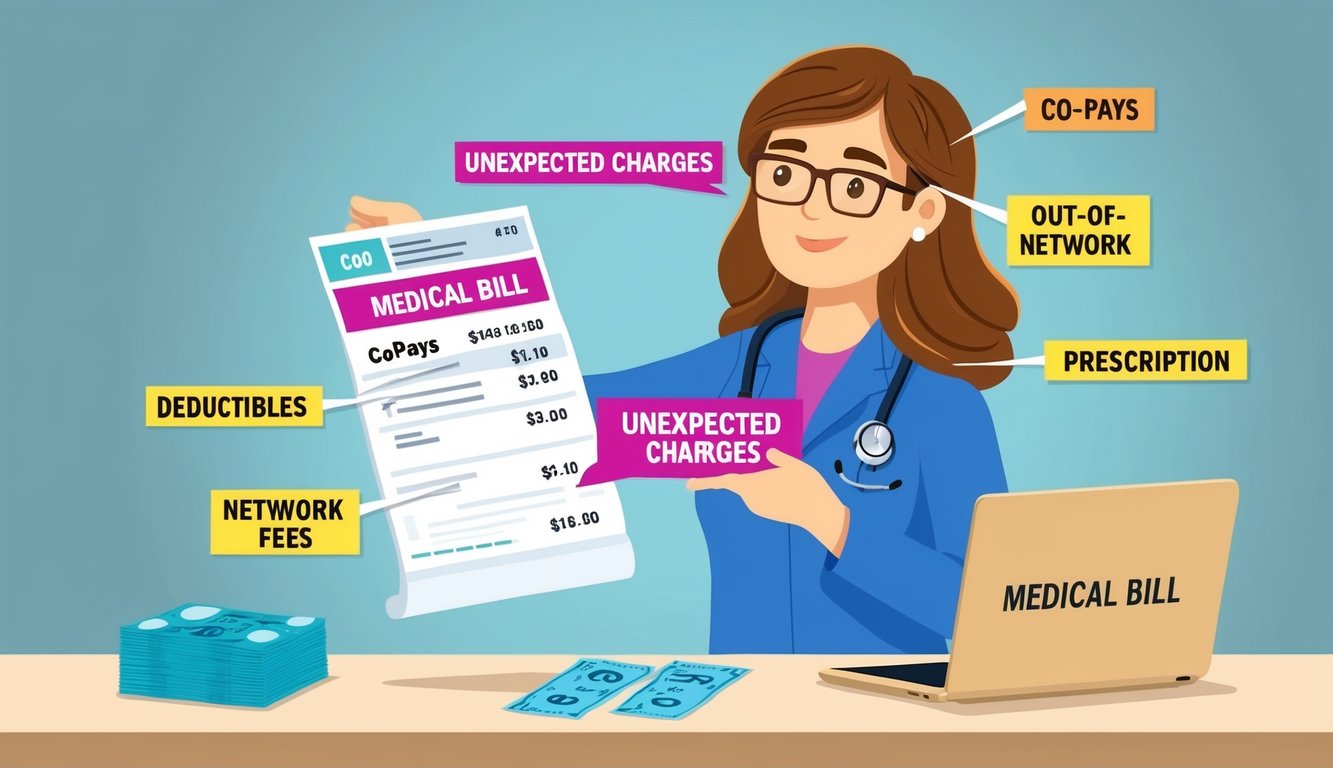

Many people focus on monthly premiums when choosing a policy, but there are often hidden costs that can significantly impact your out-of-pocket expenses.

Understanding these hidden costs can help you make more informed decisions when selecting a health insurance plan and better prepare for potential healthcare expenses. By familiarizing yourself with common but often overlooked charges, you’ll be better equipped to compare policies and choose coverage that truly meets your needs and budget.

1) Deductibles

Deductibles are a crucial component of health insurance policies that you need to understand.

A deductible is the amount you pay for certain health care services each year before your health plan starts to cover costs.

For example, if you have a $1,500 deductible, you’ll need to pay the first $1,500 of covered services out of pocket.

Only after meeting this threshold will your insurance begin to pay its share.

Deductibles reset annually, typically at the beginning of each plan year.

This means your out-of-pocket expenses start from zero when the new year begins, regardless of how much you spent in the previous year.

Deductibles can vary based on your specific plan.

A deductible around $1,400-$1,500 is generally considered high, while anything below that is considered low.

Some plans may have separate deductibles for different types of services, such as medical care and prescription drugs.

Be sure to review your policy carefully to understand how deductibles apply to various health care expenses.

Keep in mind that after meeting your deductible, you may still be responsible for copayments or coinsurance.

These are additional out-of-pocket costs that you’ll need to factor into your healthcare budget.

2) Copayments

Copayments, often shortened to copays, are fixed amounts you pay for covered healthcare services.

These flat fees are typically due at the time of service.

You might encounter different copay amounts for various services.

For example, a visit to your primary care physician could have a lower copay than seeing a specialist.

Prescription medications also often require copayments.

The amount can vary based on whether you’re getting a generic or brand-name drug.

Copays are separate from your deductible, so you usually pay them even if you haven’t met your deductible for the year.

Some plans have different copay structures.

You might have a higher copay for out-of-network providers or for certain types of services.

Copays can add up quickly if you require frequent medical care.

It’s wise to budget for these expenses, especially if you have a chronic condition requiring regular doctor visits.

Remember that preventive services are often covered without a copay under many plans.

This includes annual check-ups and certain screenings.

Understanding your plan’s copay structure can help you estimate your out-of-pocket costs more accurately.

Review your policy documents or contact your insurance provider for specific details about your copayments.

3) Non-Network Charges

Health insurance policies often have networks of approved healthcare providers.

When you seek care outside this network, you may face unexpected costs.

Non-network charges can significantly increase your out-of-pocket expenses.

These charges apply when you visit doctors, hospitals, or specialists not included in your insurance plan’s network.

Your insurance may cover a smaller percentage of non-network services, leaving you responsible for the remainder.

In some cases, they might not cover these services at all.

Surprise medical bills can result from non-network charges.

These occur when you unknowingly receive care from out-of-network providers, even at in-network facilities.

To avoid non-network charges, always verify if a provider is in your network before scheduling appointments.

This includes checking for all professionals involved in your care, such as anesthesiologists or radiologists.

Emergency situations can complicate matters.

While many plans cover out-of-network emergency care, you might still face higher costs.

The No Surprises Act, effective since January 1, 2022, offers some protection against unexpected non-network charges in certain situations.

4) Prescription Drug Tiers

When reviewing your health insurance policy, you’ll likely encounter prescription drug tiers.

These tiers categorize medications based on their cost to the insurer and determine how much you’ll pay out-of-pocket.

Most insurance plans use a three or four-tier system for prescription drugs.

Tier 1 typically includes preferred generic drugs, which are the least expensive options.

Tier 2 often consists of higher-priced generic and lower-priced brand-name drugs.

Your copayment for these medications will be higher than for Tier 1 drugs.

Tier 3 and 4 usually include more expensive brand-name drugs and specialty medications.

These tiers have the highest copayments or coinsurance rates, significantly impacting your out-of-pocket costs.

Understanding drug tiers can help you make informed decisions about your prescriptions.

You might save money by asking your doctor if there’s a lower-tier alternative to a prescribed medication.

It’s important to review your plan’s formulary or list of covered drugs regularly.

Insurance companies may change drug tiers annually, affecting your costs.

Some plans may require you to try lower-tier drugs before approving higher-tier options.

This practice, known as step therapy, can influence your treatment choices and expenses.

5) Out-of-Pocket Maximums

Out-of-pocket maximums play a crucial role in your health insurance policy.

This is the maximum amount you’ll have to pay for covered healthcare services in a plan year.

Once you reach this limit, your insurance company covers 100% of covered expenses.

It’s important to note that out-of-pocket maximums are federally mandated.

For 2024, the maximum limit for individual plans is $9,450, while for family plans, it’s $18,900.

Your out-of-pocket maximum typically includes your deductible, copayments, and coinsurance.

However, it doesn’t usually cover premiums or non-covered services.

Understanding your out-of-pocket maximum can help you budget for potential healthcare costs.

If you have ongoing medical needs, a plan with a lower out-of-pocket maximum might be beneficial.

Be aware that not every plan has an out-of-pocket maximum.

When comparing policies, always check if this feature is included and what the limit is.

Out-of-pocket maximums only apply to in-network care, so keep this in mind if you receive out-of-network services.

Lastly, for family plans, there’s an “embedded” individual out-of-pocket limit.

This means no single family member can be required to pay more than the individual maximum, even under a family plan.

6) Preventive Care Exclusions

Many people assume that all preventive care services are covered without cost-sharing under their health insurance plans.

However, this is not always the case.

While the Affordable Care Act (ACA) mandates coverage for certain preventive services, there are exceptions and limitations you should be aware of.

Some health plans may not cover all recommended preventive services.

This can lead to unexpected out-of-pocket expenses when you seek preventive care.

It’s important to note that preventive care isn’t truly free.

The cost is factored into your insurance premiums, so you’re indirectly paying for these services.

Certain preventive services may only be covered if provided by in-network doctors.

If you visit an out-of-network provider, you might have to pay the full cost.

Additionally, some plans may limit the frequency of covered preventive services.

For example, they might cover one annual physical exam but not additional check-ups within the same year.

To avoid surprises, always check your policy details or contact your insurance provider to understand which preventive services are covered and under what conditions.

7) Preauthorization Requirements

Preauthorization, also known as prior authorization, is a common requirement in health insurance policies.

It means your insurer must approve certain medical services or treatments before you can receive them.

This process can lead to unexpected costs if not handled properly.

Prior authorization is often required for expensive procedures, specific medications, or specialized treatments.

Failing to obtain preauthorization when needed can result in denied claims or reduced coverage.

You might end up paying out-of-pocket for services your insurance would have otherwise covered.

The preauthorization process can be time-consuming and may delay your treatment.

In some cases, this delay could lead to additional health complications and associated costs.

To avoid unexpected expenses, familiarize yourself with your plan’s preauthorization requirements.

Keep in close communication with your healthcare provider and insurance company when planning treatments or procedures.

Be prepared to provide detailed medical information to support your preauthorization request.

This may include test results, medical records, or a letter from your doctor explaining the necessity of the treatment.

Remember that preauthorization doesn’t guarantee coverage.

Your insurer may still deny the claim if they determine the service wasn’t medically necessary or if your policy doesn’t cover it.

Stay proactive in managing your healthcare.

Keep records of all communications with your insurance company regarding preauthorizations to protect yourself from potential disputes or claim denials later on.

8) Surprise Billing

Surprise billing can be an unexpected and costly aspect of health insurance.

It occurs when you receive care from out-of-network providers, often without your knowledge or consent.

Surprise bills typically arise in emergency situations or when receiving treatment at in-network facilities.

You might be treated by an out-of-network specialist or anesthesiologist, leading to additional charges.

The No Surprises Act aims to protect patients from these unexpected costs.

This legislation, effective since January 1, 2022, prohibits certain types of surprise billing practices.

Under this act, emergency services must be billed at in-network rates, even if provided by out-of-network facilities.

It also restricts balance billing for non-emergency services at in-network hospitals.

If you receive a surprise bill, don’t panic.

Review it carefully and contact your insurance provider for clarification.

You can also call the provider for an explanation, as it might be a billing error.

If you’re still unsure, the Department of Health and Human Services has established a No Surprises Helpdesk at 800-985-3059 to assist with complaints related to surprise bills.

Remember to always ask about network status before receiving non-emergency care.

This proactive approach can help you avoid unexpected costs and make informed decisions about your healthcare.

Understanding Common Health Insurance Terms

Health insurance policies contain crucial terms that impact your coverage and costs.

Familiarizing yourself with these terms helps you make informed decisions about your healthcare.

Premiums and Deductibles

Premiums are the regular payments you make to maintain your health insurance coverage.

You typically pay these monthly, regardless of whether you use medical services.

Deductibles represent the amount you must pay out-of-pocket for covered services before your insurance starts to contribute.

For example, if your deductible is $1,000, you’ll pay the full cost of services until you reach that amount.

High-deductible health plans (HDHPs) have lower premiums but higher deductibles.

These plans often pair with Health Savings Accounts (HSAs), allowing you to save money tax-free for medical expenses.

Copayments and Coinsurance

Copayments are fixed amounts you pay for specific services, such as $20 for a doctor’s visit or $10 for a prescription.

These fees are typically due at the time of service.

Coinsurance is the percentage of costs you pay for covered services after meeting your deductible.

For instance, if your coinsurance is 20%, you’ll pay 20% of the allowed amount for a service, while your insurance covers the remaining 80%.

It’s important to note that copayments and coinsurance can vary depending on whether you use in-network or out-of-network providers.

In-network services usually result in lower out-of-pocket costs for you.

Hidden Costs in Out-of-Network Services

Out-of-network services can lead to unexpected expenses in your health insurance coverage.

These costs often arise from emergency room visits and specialist consultations, catching many policyholders off guard.

Emergency Room Visits

When you visit an out-of-network emergency room, you may face significantly higher charges.

Your insurance might only cover a fraction of the bill, leaving you responsible for the remainder.

This can result in substantial out-of-pocket expenses, even if you have insurance.

Emergency situations often don’t allow time to check if a facility is in-network, making these costs particularly challenging to avoid.

The No Surprises Act, effective January 1, 2022, offers some protection against unexpected bills for emergency services.

However, it’s crucial to understand your policy’s specifics regarding out-of-network emergency care.

Specialist Consultations

Seeking care from out-of-network specialists can also result in hidden costs.

Your insurance may cover a lower percentage of the charges or none at all, depending on your policy terms.

Some plans require referrals for specialist visits.

Without proper authorization, you might be responsible for the full cost of the consultation, even if the specialist is in-network.

It’s essential to verify a specialist’s network status before scheduling an appointment.

You should also check if your plan requires pre-authorization for specialist visits to avoid unexpected expenses.

Remember, out-of-network providers may charge higher rates than in-network ones for the same services.

Always review your policy’s out-of-network coverage and consider the potential financial impact before seeking care outside your network.

Additional Costs for Prescription Drugs

Prescription drug coverage can significantly impact your out-of-pocket expenses.

Understanding formulary restrictions and tiered pricing structures is crucial for managing your healthcare costs effectively.

Formulary Restrictions

Formularies are lists of approved medications covered by your insurance plan.

Many insurers limit coverage to specific brands or generic alternatives.

If your prescribed medication isn’t on the formulary, you may face higher costs or no coverage at all.

To navigate formulary restrictions:

- Review your plan’s formulary before filling prescriptions

- Ask your doctor about generic alternatives

- Request a formulary exception if medically necessary

Some plans use step therapy, requiring you to try less expensive options before covering pricier drugs.

This can delay access to certain medications and increase your initial expenses.

Tiered Pricing Structures

Insurance plans often use tiered pricing for prescription drugs.

Tiers typically range from lowest to highest cost:

- Generic drugs

- Preferred brand-name drugs

- Non-preferred brand-name drugs

- Specialty drugs

Your copayment or coinsurance increases with each tier.

For example, you might pay $10 for a generic drug but $50 for a non-preferred brand-name medication.

To minimize costs:

- Opt for generics when available

- Check if your medications are on the preferred drug list

- Consider mail-order pharmacy services for long-term prescriptions

Some plans have separate deductibles for prescription drugs, potentially increasing your upfront costs.