Whole life insurance offers more than just a death benefit.

This type of permanent life insurance provides lifelong coverage and can accumulate cash value over time. Many people are unaware of the additional advantages that whole life policies can offer beyond basic protection.

When considering life insurance options, it’s important to understand the full range of benefits available.

Whole life insurance has several features that set it apart from term life policies.

These lesser-known advantages can make whole life insurance an attractive choice for certain financial situations and long-term goals.

1) Guaranteed Death Benefit

Whole life insurance offers a guaranteed death benefit, ensuring your beneficiaries receive a predetermined sum when you pass away.

This feature provides peace of mind, knowing your loved ones will be financially protected regardless of when you die.

Unlike term life insurance, which expires after a set period, whole life insurance covers you for your entire lifetime.

As long as you pay your premiums, the death benefit remains in force, providing lifelong protection for your family.

The guaranteed death benefit can be a valuable tool for estate planning.

It can help cover estate taxes, equalize inheritances among beneficiaries, or create generational wealth.

This feature allows you to leave a lasting financial legacy for your loved ones.

One of the key advantages of this benefit is its tax treatment.

In most cases, the death benefit is not subject to federal income taxes.

This means your beneficiaries receive the full amount, maximizing the financial support you leave behind.

The guaranteed death benefit also provides stability in your financial planning.

You can confidently make long-term decisions knowing the exact amount your beneficiaries will receive.

This certainty can be particularly valuable when planning for your family’s future or business succession.

2) Cash Value Accumulation

Whole life insurance policies offer a unique benefit: cash value accumulation.

This feature sets them apart from term life insurance.

Your policy’s cash value grows over time, typically at a fixed rate determined by the policy’s terms.

The growth starts slowly but accelerates as the years pass.

You can think of the cash value as a savings account within your insurance policy.

A portion of your premium payments goes towards building this cash value.

The cash value component offers you financial flexibility.

You can borrow against it, use it to pay premiums, or even surrender the policy for its cash value.

Some policies allow you to earn dividends, which can further increase your cash value.

These dividends are not guaranteed but can provide additional growth potential.

Your cash value grows tax-deferred, meaning you won’t pay taxes on the gains as long as the policy remains in force.

This can be a significant advantage for long-term financial planning.

As you age, the cash value can become a valuable asset.

You might use it to supplement your retirement income or cover unexpected expenses.

Remember, the growth rate for whole life insurance cash value is often around 2%.

While this may seem modest, the guaranteed nature of the growth can provide peace of mind.

3) Tax Advantages

Whole life insurance offers several tax benefits that you may not be aware of.

These advantages can make it an attractive option for financial planning and wealth preservation.

One key benefit is the tax-free death benefit.

When your beneficiaries receive the payout from your policy, it’s generally income tax-free.

This means your loved ones get the full amount you’ve designated without income tax reductions.

The cash value component of whole life insurance also has tax advantages.

As your policy accumulates cash value over time, this growth is tax-deferred.

You don’t pay taxes on the increasing value while it remains in the policy.

You can access the cash value through policy loans without triggering a taxable event.

These loans are typically tax-free as long as the policy remains in force.

This feature provides a flexible way to use your policy’s value during your lifetime.

Whole life insurance can be a useful tool for estate planning.

It can help minimize taxes and provide liquidity for your heirs to cover estate taxes or other expenses.

In certain situations, you may be able to exchange your whole life policy for another life insurance policy or annuity without incurring taxes.

This is known as a 1035 exchange and can offer flexibility in adjusting your coverage as your needs change.

4) Loan Opportunities

Whole life insurance policies offer a unique financial advantage through their loan options.

As your policy accumulates cash value over time, you gain the ability to borrow against it.

These loans provide flexibility and accessibility to funds when you need them most.

You can borrow up to 90% of your policy’s cash value in many cases, giving you a substantial financial cushion.

One key benefit is the favorable interest rates.

Whole life insurance loans often come with lower interest rates compared to traditional bank loans.

This can make them an attractive option for various financial needs.

You have the freedom to use the borrowed money for any purpose.

Whether it’s for a home renovation, starting a business, or covering unexpected expenses, the choice is yours.

Another advantage is that these loans are typically tax-free.

Unlike withdrawals from certain accounts, borrowing against your whole life policy doesn’t trigger immediate tax consequences.

It’s important to note that the loan uses your cash value as collateral.

This means you’re essentially borrowing from yourself, maintaining control over your financial assets.

While you’re not obligated to repay the loan, doing so ensures your death benefit remains intact for your beneficiaries.

This loan feature adds a layer of financial security and versatility to your whole life insurance policy.

5) Dividend Payments

Dividend-paying whole life insurance offers a unique benefit that many policyholders overlook.

When you purchase this type of policy, you become eligible to receive dividend payments from the insurance company.

These dividends are typically distributed annually and represent a portion of the insurer’s profits.

The amount you receive often depends on factors like the size of your policy and the company’s financial performance.

You have several options for using your dividend payments.

You can choose to receive them as cash, apply them to reduce your premium payments, or use them to purchase additional coverage.

Dividend-paying whole life insurance allows you to participate in the company’s success.

As your policy grows, so does your potential for larger dividend payments.

It’s important to note that dividends are not guaranteed.

However, many established insurance companies have consistent track records of paying dividends to policyholders.

These payments can provide you with additional financial flexibility.

Over time, they may contribute significantly to your policy’s overall value and potentially enhance your long-term financial strategy.

6) Estate Planning Tool

Whole life insurance serves as a valuable estate planning tool.

It provides a way for you to leave a financial legacy to your beneficiaries while potentially minimizing tax implications.

When you pass away, your beneficiaries receive the death benefit quickly, often within two weeks to two months.

This can provide immediate financial support during a difficult time.

Whole life insurance can help cover estate taxes, preserving more of your assets for your heirs.

Federal estate taxes can be substantial, and some states impose additional taxes.

The death benefit from a whole life policy is generally tax-free.

This means your beneficiaries receive the full amount without having to pay income tax on it.

You can use whole life insurance to equalize inheritances among your heirs.

For example, if you leave a business to one child, you can use life insurance to provide an equivalent inheritance to another.

Whole life policies can also help you avoid probate.

The death benefit typically passes directly to your beneficiaries, bypassing the potentially lengthy and costly probate process.

Consider consulting with a financial advisor or estate planning attorney to determine how whole life insurance can best fit into your overall estate plan.

They can help you structure your policy to meet your specific needs and goals.

7) Long-Term Savings

Whole life insurance offers a unique opportunity for long-term savings.

As you pay your premiums, a portion goes towards building cash value within the policy.

This cash value grows tax-deferred over time.

You don’t pay taxes on the growth as long as the money remains in the policy.

You can access this cash value through policy loans or withdrawals.

This feature provides a financial safety net for unexpected expenses or opportunities.

The guaranteed cash value component of whole life insurance offers stability.

Unlike other investment options, it’s not subject to market fluctuations.

Many whole life policies also pay dividends.

While not guaranteed, these can significantly boost your policy’s cash value over time.

The long-term nature of whole life insurance encourages disciplined saving.

Your regular premium payments build substantial cash value over decades.

This savings component can supplement your retirement income.

You can use the accumulated cash value to help fund your golden years.

Remember, whole life insurance combines protection and savings.

It provides a death benefit for your loved ones while also building a financial resource you can use during your lifetime.

Understanding Whole Life Insurance

Whole life insurance provides lifelong coverage with fixed premiums and a cash value component.

This type of policy offers stability and financial protection for you and your beneficiaries.

Permanent Coverage

Whole life insurance lasts for your entire lifetime, unlike term life insurance which expires after a set period.

As long as you pay your premiums, your policy remains active.

This permanent coverage ensures your beneficiaries will receive a death benefit regardless of when you pass away.

It provides peace of mind, knowing your loved ones will be financially protected.

The policy’s cash value grows over time, offering a savings component alongside the death benefit.

You can borrow against this cash value or use it to pay premiums in the future.

Guaranteed Premiums

Your premiums stay the same throughout the policy with whole life insurance.

This predictability makes budgeting easier and protects you from future rate increases.

Fixed premiums are especially beneficial if you purchase a policy when you’re young and healthy.

Your rates will remain low even as you age or develop health issues.

The guaranteed premium structure ensures your policy remains affordable throughout your lifetime.

This stability allows you to maintain coverage without worrying about cost fluctuations.

You can choose to pay premiums monthly, quarterly, or annually, depending on your financial situation and preferences.

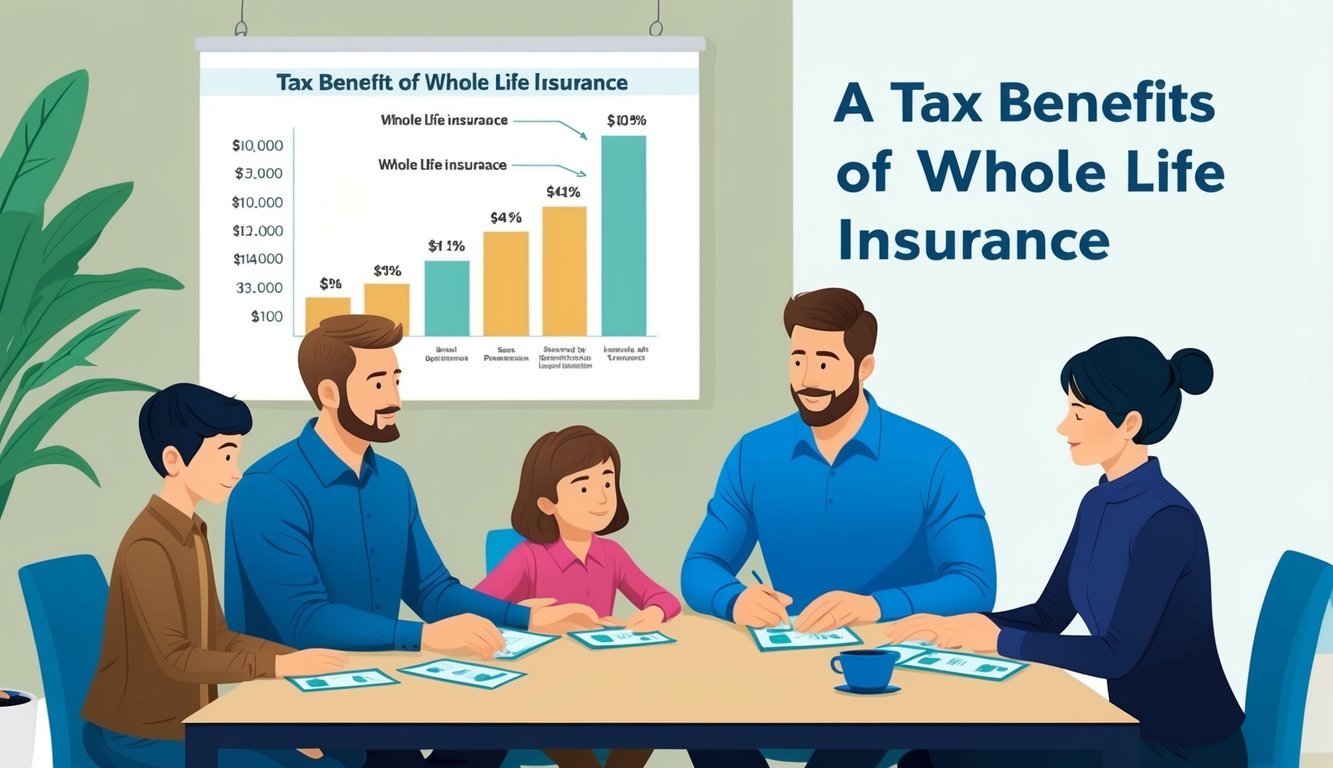

Tax Benefits of Whole Life Insurance

Whole life insurance offers significant tax advantages that can enhance your financial strategy.

These benefits include tax-deferred growth of cash value and a tax-free death benefit for your beneficiaries.

Tax-Deferred Growth

The cash value component of whole life insurance grows tax-deferred.

This means you don’t pay taxes on the growth as it accumulates within the policy.

Your money compounds faster, potentially leading to greater wealth accumulation over time.

You can access this cash value through policy loans without triggering a taxable event.

This provides a tax-advantaged way to access funds for various needs, such as supplementing retirement income or covering unexpected expenses.

It’s important to note that withdrawals up to your base premium are typically tax-free.

However, withdrawals exceeding your cost basis may be subject to taxation.

Tax-Free Death Benefit

One of the most significant tax benefits of whole life insurance is the tax-free death benefit.

When you pass away, your beneficiaries receive the policy’s death benefit without having to pay income tax on the proceeds.

This tax-free status can be particularly valuable for estate planning purposes.

It allows you to transfer wealth to your heirs efficiently, potentially avoiding estate taxes if the policy is properly structured.

The tax-free nature of the death benefit ensures that your loved ones receive the full amount you intended, without reduction due to taxes.

This can provide financial security and help maintain their standard of living after your passing.

Financial Flexibility and Stability

Whole life insurance offers unique financial advantages beyond its death benefit.

It provides options for accessing funds and building wealth over time, enhancing your long-term financial security.

Cash Value Component

Whole life policies accumulate cash value over time.

This cash value grows tax-deferred, meaning you won’t pay taxes on the gains as long as the policy remains active.

You can use this cash value in several ways:

- Pay premiums

- Supplement retirement income

- Cover unexpected expenses

The growth rate is typically guaranteed, providing a stable and predictable financial asset in your portfolio.

This feature sets whole life insurance apart from term policies, which lack a cash value component.

Loan Options

Your whole life policy’s cash value allows you to borrow against it.

This creates a flexible financial resource you can tap into when needed.

Key points about policy loans include:

- Generally lower interest rates than traditional loans

- No credit check required

- Flexible repayment terms

You’re essentially borrowing from yourself, but you need to repay the loan to maintain your death benefit.

If you don’t repay it, the outstanding balance will be deducted from the death benefit paid to your beneficiaries.

Policy loans can be used for various purposes.

This feature provides you with financial options without the need to liquidate other investments or assets.